Ratio Analysis - Notes

Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by studying its financial statements such as the balance sheet and income statement. It involves the construction of ratios using specific elements from the financial statements in ways that help to identify the strengths and weaknesses of the firm. They are mainly used by external analysts to determine various aspects of a business, such as its profitability, liquidity, and solvency.

Uses/advantages of Ratio Analysis:

1. It helps to calculate the profitability of the organization.

2. It helps to evaluate the solvency of the organization.

3. It helps in comparative analysis of the financial performance.

4. It helps in managerial decision-making.

5. It helps in forecasting.

6. It helps to workout operational efficiently.

7. It helps in budgetary control.

Limitation of Ratio Analysis:

1. It doesn’t consider the size of the organization.

2. Based on historical data.

3. Ignores qualitative aspects.

4. Ignores the impact of inflation.

5. Doesn’t resolve the financial problem.

6. Not comparable results among organizations that follow different accounting policies.

Type of ratios:

1) Liquidity ratios

2) Turnover Ratios

3) Profitability ratios

4) Solvency Ratios

1) Liquidity Ratios:

Liquidity ratios mean the ability of the business to pay its short-term liabilities. Short-term lenders and creditors of a business are very much interested to know its state of liquidity because of financial stake. Two types of liquidity ratios are the Current Ratio and the Quick Ratio.

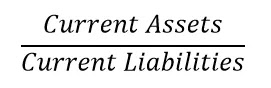

a) Current Ratio:

The current ratio is one of the best-known measures of short-term solvency. It is the most common measure of short-term liquidity.

Formula, Current Ratio =

Current Assets = Inventories +Sundry Debtors+ cash and bank balance+ receivables +loans and advances etc

Current liabilities = creditors + short term loans + cash credit + o/s expense + provisions for tax + proposed dividend etc

The generally accepted current ratio is 2:1

Importance of Current Ratio:

a) Explains the liquidity position of the company.

b) Gives ideas about the operating cycle of the company.

c) Shows how efficiently management functions

d) Facilitates in fund management

e) Establish the ability of the management to discharge the creditor’s obligations.

Limitations of Current Ratio:

a) Not sole indicator of the financial liquidity position of the company as it gives less information about working capital.

b) Inventory position may overstate ratio.

c) Equal change in assets and liabilities may also change the ratio.

b) Quick Ratio: it is also called an acid test. The quick ratio is a much more conservative measure of short-term liquidity than the current ratio.

Quick Assets = CA – inventory- prepaid expense.

2) Turnover Ratios:

These ratios are employed to evaluate the efficiency with which the firm manages and utilizes its assets. They are also called assets management ratios. These ratios indicate the frequency of sales concerning its assets.

Type of turnover ratios are:

a) Inventory turnover ratio

b) Receivables turnover ratio

c) Total assets turnover ratio

d) Fixed assets turnover ratio

a) Inventory Turnover ratio:

This ratio is also known as the stock turnover ratio. This ratio establishes the ratio between the costs of goods sold and average inventory. It measures the efficiency with which a firm utilizes or manages its inventory. It indicates how fast inventory is used or sold.

Inventory Turnover Ratio =

Average Inventory =

Note: High ratio is good from the viewpoint of liquidity and vice-versa.

b) Receivables Turnover ratio:

Also called debtors’ turnover ratio. This ratio defines how efficient a company is in extending credit as well as collecting debts. A high ratio is desirable, as it indicates that the company's collection of accounts receivable is efficient.

Debtor turnover ratio =

c) Total assets turnover ratio:

This ratio measures the efficiency with which a firm uses its assets in generating sales or revenue. A company with high assets turnover ratio is said to be in operation more efficiently than the one with less ratio.

Total assets turnover ratio:

3) Profitability Ratio:

Profitability ratios measure the profitability of the operational efficiency of the firm. These ratios reflect the final results of the business operations. Management always tries to maximize the profitability ratios to maximize the value of the firm. A profitability ratio is a category falling under financial ratios that are used by investors, bankers, financial institutions, creditors, and other stakeholders for evaluation of the financial performance of the company in regards to annual profitability.

Some of the important profitability ratios are:

A) Gross Profit Ratio

B) Net Profit Ratio

C) Return on Investments

D) Return on Capital Employed.

E) Return on Assets

F) Return on Equity

G) Earnings per Share (EPS)

Importance of Profitability Ratio

a) It helps to identify the operational efficiency of the firm (GP Ratio).

b) It helps to identify the overall performance of the firm (NP Ratio).

c) Helps in monitoring the efficiency in utilizing the assets (Return of Assets).

d) Facilitates in injecting additional funds into the company.

e) Provides information to the shareholders about the current position of the firm

f) Judges the efficiency of the management (ROCE).

Limitations of Profitability Ratio:

a) Doesn’t facilitate comparisons among firms of different industries.

b) These ratios may be manipulated by the management based on the outcome they need.

c) Considers book's value of the assets.

Now let us explain each of the above-mentioned ratios is brief:

A) Gross Ratio:

It represents the percentage of each sale in rupees remaining after payment for the goods sold.

GP Ratio =

Where Gross Profit = Sales – Cost of goods sold.

A high GP Ratio is favorable for management.

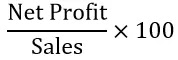

B) Net Profit Ratio:

It measures the relationship between net profit and sales of the business. This ratio measures the profitability of the business.

NP Ratio =

Where Net Profit = Total Sales – Total Expense

A high GP Ratio is favorable for management.

C) Return on Investments:

This ratio represents returns on funds invested in the business by its owners. In short, this ratio tells the owner if all the efforts put in the business are worthwhile.

Return on investments =

Also, ROI = Profitability Ratio × Investment Turnover Ratio

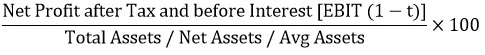

D) Return on Assets:

This ratio represents the relationship between net profits earned and assets that have been employed to earn that profit. This ratio measures profitability in terms of assets employed in the firm.

Return on Assets =

E) Return on Capital Employed:

This ratio represents the relation between the profit earned by the business and the capital employed in the business.

ROCE =

Where capital employed = Total Assets (excluding fictitious assets) – Current Liabilities

F) Return on Equity:

This ratio measures the profitability of equity funds invested in the firm. The ratio explains how properly the funds of the owner have been used in the business. Companies that have a high return on equity can grow without large capital expenditures.

ROE =

G) Earnings Per Share:

The profitability of a firm from the point of view of ordinary shareholders can be measured in terms of equity shares. This is known as Earnings per Share.

Earnings per share =

4) Leverage Ratios:

Leverage ratios are those ratios that represent the proportion of the debts of the business as compared to its own funds. This ratio measures the long-term solvency and liquidity position of the firm. The leverage ratio ensures the lender of the long-term funds about the payment of interest and repayment of principal. These ratios are also known as solvency ratios and capital structure ratios.

Some of the important leverage ratios are:

A) Debt to Equity Ratio

B) Interest Coverage Ratio

C) Capital Gearing Ratio

Importance of Leverage Ratio

a) Helps to understand the capital structure of the firm.

b) Shows Long term liquidity position of the firm.

c) Helps in obtaining loans from Bank and FIs

d) Tax Benefits

Limitations of Leverage Ratio:

a) Difficult to obtain loans.

b) Focus on the number of borrowings rather than the ability to pay

c) Not enough for measuring credit risk.

A) Debt to Equity Ratio:

This ratio measures the proportion of debt funds about the total equity of the firm. A high Debt equity ratio means less protection for creditors. This ratio is the indicator of a firm’s financial leverage.

Debt Ratio =

Where Total Debt long term liabilities.

Total equity includes Preference shares

B) Interest Coverage Ratio:

This ratio represents the firm’s ability to meet the fixed charge obligation (Interest). A high-interest coverage ratio means that enterprises can easily meet their obligations even if EBIT suffers a considerable decline. A lower ratio means an entity has excessive debts or inefficient operations.

Interest Coverage Ratio =

C) Capital Gearing Ratio:

This ratio shows the proportion of fixed interest-bearing capital to funds belonging to equity shareholders.

Capital Gearing Ratio =