FINANCIAL STATEMENTS

Bank and financial institutions are required to prepare financial statements every year to show the true and fair picture of their financial position. Directives No. 4, directs banks and financial institutions to prepare financial statements. Directive 4 requires banks and financial institutions to prepare financial statements by complying with the provisions of the Nepal Financial Reporting Standard (NFRS). For any matters not mentioned in directive 4, International Financial Reporting Standards (IFRS) shall apply.

Financial Statements shall consist of:

A) Statement of Financial Position

B) Statement of Profit or Loss

C) Statements of cash flows

D) Statements of changes in equity

E) Notes forming an integral part of financial statements

PROFIT & LOSS ACCOUNT/STATEMENT OF PROFIT OR LOSS:

A profit & loss account is the financial statement of a company that shows complete information about the expenses, losses, income, and gains. It is also called an income statement. It is often the most popular and common financial statement in a business plan as it quickly shows how much profit or loss is generated by a business over the period. Preparation of the P&L account begins with showing the total operating revenue of the income and deducting from it all the direct expenses.

The resultant amount is gross profit. All indirect expenses are then deducted from gross profit and all non-operating income are added to it to calculate net profit which is distributed to the shareholders. All expenses and losses of the company are shown on the debit side of the P&L account. All incomes and gains are shown on the credit side of the P&L account. A profit and loss account, hence, can be said to be a nominal account. Profit and loss accounts are prepared for the particular period.

According to Prof. Carter, “A profit and loss account is an account into which all gains and losses are collected to ascertain the excess of gains over the losses or vice versa.

Some of the major headings of the P&L account is:

a) Operating Income

b) Cost of sales

c) Gross Profit

d) Other Income

e) Administrative expense

f) Employee expenses

g) Depreciation & Amortization

h) Operating Profit/ EBIT

i) Net Finance Cost

j) Earning Before Tax

k) Tax

l) Earning After Tax

a) Operating income:

All operating incomes earned by the entity during the period are recorded under operating income. All cash, as well as credit sales, are recorded here.

b) Cost of goods sold:

All direct expenses which are made by the company for earning direct revenue are recorded here. Opening stock and closing stock are added and subtracted respectively from direct expense to calculate the cost of goods sold.

c) Gross Profit:

Gross profit is the profit earned after deducting the cost of goods sold from direct revenue. It is also known as impure profit.

d) Other income:

All non-operating incomes like insurance compensation received, rent received, interest on investments, forex gain, etc are shown under this head.

e) Administrative expenses:

Under this head, we record all the administrative expenses of the organization like insurance cost, printing expense, rent, repair and maintenance, postage and courier, security expense, bad debts, etc.

f) Employee expenses:

Under this head, salary, allowances paid to the employees, provident fund expense, gratuity expense, etc are shown. This head shows expenses made by the entity for the employees of the organization.

g) Depreciation and amortization:

Under this head expenses made for wear and tear of tangible as well as intangible assets are disclosed. Depreciation of tangible fixed assets and amortization of non-tangible fixed assets are recorded at different rates of depreciation depending upon the nature of the assets.

h) Earnings Before Interest and Tax:

This heading shows the earnings of the business before deducting interest and tax. Here all the expenses/losses, income/gains of the company other than interest and taxes are recorded.

i) Tax:

This head includes the provision made for the tax that needs to be paid by the company to the government. It also includes deferred tax expenses/incomes.

j) Earning after tax:

This is the net profit earned by the entity during the particular period. This profit is distributed to the shareholders and the balance if any shall be t/f to reserves and surplus.

Advantages of Profit or Loss account:

a) To give information about the actual profitability position of the entity. It provides information about the net profit or net loss earned by the company during the particular period.

b) It also provides information about the total expense made by the company during the particular period.

c) It provides information about the total operating as well as non-operating income of the entity.

d) It also helps in evaluating the business operation by calculating various ratios like net profit ratio, gross profit ratio, Return on capital employed, etc

e) Payment of bonus is the legal obligation of the company. Profit & loss account helps to calculate bonus that needs to be paid to the employees of the organization.

f) It facilitates the calculation of the tax which needs to be paid to the central government. Taxable income as per the income tax act is calculated by adding and subtracting the expenses and incomes allowed under tax once the net profit of the company is determined.

g) It is a useful tool for cost control as it provides a comparison among the expenses made by the entity over the periods.

h) It facilitates in preparation of the Balance sheet.

i) It facilitates during an audit.

Dis-advantages of Profit & Loss account:

a) Doesn’t consider non-monetary events.

b) Uses accrual basis of accounting hence entries are recorded before actual cash flows.

c) Chances of manipulations by over-inflating profit.

d) Doesn’t provide information about the financial position of the organization.

Objectives of profit or loss account

a) To identify the profit earned by the company over a certain period.

b) To facilitate in preparation of the Balance sheet.

c) To identify the sources of different sources of income

d) To provide information about the individual expenses made by the entity over the period.

e) To control the cost to increase the net profit of the entity.

Characteristics of Profit or Loss account

a) Prepared periodically: Monthly, quarterly or yearly.

b) Shows information about the Income, expense, losses, and gains.

c) Includes non-cash items like depreciation & amortization

d) Only shows monetary activities.

e) Capital expenditure made by the entity is not shown in this statement.

BALANCE SHEET/STATEMENT OF FINANCIAL POSITION

A balance sheet or statement of financial position is a statement that reports the position of an entity’s assets, liabilities, and shareholder’s equity. It provides information about the entity’s economic resources and claims against those resources by the creditors and owners on a particular date. It is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders.

The balance sheet is used alongside other important financial statements such as the income statement and statement of cash flows in conducting fundamental analysis or calculating financial ratios. The left side column of the balance sheet shows shareholder’s equity, long-term liabilities, and short-term liabilities. Similarly, the right-hand side column shows Tangible assets, Intangible assets, investments, and current assets.

The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity.

Objectives of Balance Sheet:

a) To Shows Financial Position) To Provide Information about capital and owner’s equity

c) To provide Information about current assets and current liabilities

d) To Provide information about fixed assets and investments

Advantages of preparation of Balance Sheet:

a) It provides a state of affairs of a business:

The balance sheet provides a true and fair view of the statement of affairs of the entity by providing the actual position of assets and liabilities of the company as on a particular date.

b) Analysis of the liquidity position of the entity:

The balance sheet provides the information of the current assets and current liabilities of the entity thus analyzing its liquidity strength.

c) Can be used to secure long term and short term loans:

Your balance sheet allows people outside of your company to quickly understand its financial condition. Most lenders require a balance sheet to determine a business’s financial health and credit worthiness. Additionally, potential investors may use it to understand where their funding will go and when they can expect to be repaid.

d) Helps to calculate financial ratios:

The balance sheet facilitates the calculation of helpful ratios like current ratio, debt-equity ratio, etc.

e) It helps on comparison of assets and liabilities:

The balance sheet helps in the comparison of assets and liabilities of the entity over the two different dates/period. This will help to identify the growth or downfall of the financial position of the entity.

f) Helps to disclose solvency:

The balance sheet provides the detailed position of the assets and liabilities of the entity. Hence at its glance users can know the current solvency position of the entity.

g) Helps to ascertain owner’s equity:

The balance sheet discloses the information about the authorized capital, issued subscribed, and paid-up capital and position of reserves and surplus of the organization as on a particular date.

h) Helps to ascertain debtors and creditors position:

The balance sheet provides the position of debtors and creditors of the organization as on a particular date. This is will in the analysis of credit received and credit allowed during purchase and sales of the services/goods.

LIMITATIONS OF BALANCE SHEET

a) Recording at historical costs:

The balance sheet records all assets and liabilities at cost. Some of the value of the assets like investments may yield less value in the market than that shown in the balance sheet. Hence it doesn’t provide a true and fair view of the state of affairs of the entity.

b) Use of estimates & judgments:

Preparation of balance sheet requires the use of judgments & estimates from management. Valuation of inventory, writing off of debtors, provision for expenses, etc requires management estimates. These estimates may not be proper at all times.

c) Doesn’t consider valuable non-monetary items:

Valuable information like the emergence of multi-national competitors is not disclosed in the balance sheet. It omits to show information like skills, intelligence, honesty, and loyalty of workers.

d) Requires expert knowledge and skills:

Preparation of balance sheet requires expert knowledge. Not every person working in the accounts departments have the knowledge and expertise to prepare a balance sheet.

COMPONENTS OF BALANCE SHEET:

1) LIABILITIES:

Liabilities are the claims over the assets of the company. The liabilities side of the balance sheet shows shareholder’s funds and short and long-term obligations of the company. Some of the items disclosed on the liabilities side of the balance sheet are capital, drawings, reserves, and surplus, retained profit, debentures, creditors, accounts payable, etc. Three major headings of liabilities side of the balance sheets are:

A) Shareholder’s fund:

This includes share capital, reserves, and surplus and retained profit earned by the shareholders in respect of their capital.

B) Non-current liabilities:

Those liabilities that need to be settled after one year are known as non-current liabilities.

They include secured and unsecured loans, debentures, etc.

C) Current liabilities:

Those liabilities that need to be settled within 1 year of the operating cycle are known as current liabilities. Example: creditors, short-term loans, accounts payable, o/s expenses, tax payable, salary payable, provisions, etc.

2) ASSETS:

Assets are economic resources reported in the balance sheet which are owned or control by the entity. There are two types of assets: non-current assets and current assets. Items that are re-disclosed in the assets side of the balance sheet are land and building, furniture, plant, and machinery, goodwill, prepaid expense, cash & bank, stock, debtors, accounts receivable, etc. The major headings of Assets are:

A) Non-current assets:

Those assets that are not held in the organization for sale and are used for more than one year are known as non-current assets. They are further classified as Tangible assets, intangible assets, and investments.

a) Tangible assets: Non-current assets which are physically seen are known as tangible assets. For example, land & building, plant & machinery, furniture, vehicles, office equipment, computer, etc.

b) Intangible assets: assets that do not have physical substance are known as intangible assets.

Example: goodwill, software, trademarks, patents, etc.

c) Investments: Investments made by a company that is held for more than 1 year are also noncurrent assets. Example: investments in shares, debentures, etc. Note, if any investments are short-term in nature then they are categorized as current assets.

B) Current assets:

Those assets that are held in an organization that is expected to be realized in cash or sold or consumed within 1 year are known as current assets. Some of the examples are inventory (stock), cash and bank, debtors, accounts receivable, prepaid expenses, short-term investments, etc.

DIFFICULTIES THAT ARISE IN PREPARATION OF BALANCE SHEET:

a) Expertise knowledge:

Preparation of balance sheet requires expert knowledge. Not every person working in the accounts departments have the knowledge and expertise to prepare a balance sheet.

b) Estimations and judgments:

Preparation of balance sheet requires the use of judgments& estimates from management. Valuation of inventory, writing off of debtors, provision for expenses, etc. requires management estimates. These estimates may not be proper at all times.

c) Mistakes in the classification of transactions:

Another important problem that arises in the preparation of the balance sheet is a mistake in the classification of transactions from trial balance. Every transaction summarized in Trial Balance is transferred to either a profit & loss account or a Balance sheet. Mistakes are made in these transfers. The person involved in the preparation of the balance sheet may also categorize assets as liabilities and vice-versa.

d) Preparation of Balance sheet through adjusting entries:

Adjustment entries create difficulties in the preparation of the balance sheet. Sometimes the person assigned with the responsibility for the preparation of the balance sheet omits adjustments entries or fails to give their double impact.

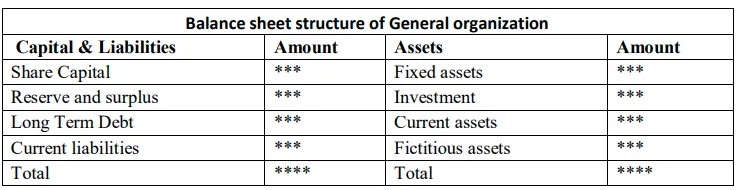

FORMAT OF BALANCE SHEET

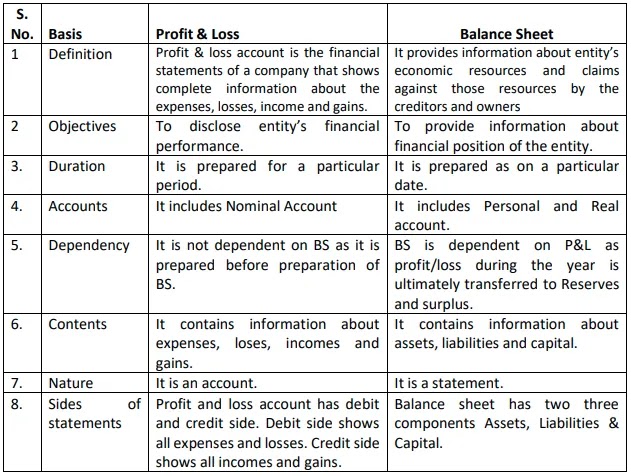

DIFFERENCE BETWEEN PROFIT & LOSS AND BALANCE SHEET

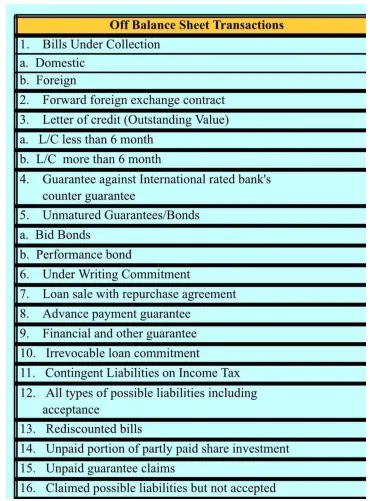

Off-Balance Sheet Items:

Some of the Off-Balance Sheet Items:

1) Bills for collection: documents provided to the bank for collection of amount.

2) Bid Bond: Guarantees given to the bond owner if a bidder fails to pay.

3) Performance Bond: Gurantenee given that the contract will be completed as agreed. 4) Underwriting commitment: Guarantee that securities offered for sale will be purchased by the underwriter and the amount will be paid irrespective of the sales of those securities.

5) Loan sale with repurchase agreement: Repurchase agreements allow the sale of a security to another party with the promise that it’ll be purchased again later at a higher price. The buyer also earns interest.

6) Irrevocable Loan Commitment: This means a loan commitment made by the bank which cannot be revoked without the consent of the customers.