ECONOMICS

FISCAL POLICY & TRADE POLICY

Nepal's budget history dates back to 1951

The first annual budget was presented in 1951. The budget covered the period March 1951-February 1952. Since there was no legislature because Nepal’s political history was going through the beginning of the transitional phase, the first budget (1951-52) was presented at the end of the year BS 2007 through Radio Nepal. The budget amount was Rs. 5,25,29,000. It had set a goal of collecting taxes amounting to Rs. 3,06, 19,000. finance minister Subarna Shamsher was one of the members of the council of ministers led by the then Prime Minister Matrika Prasad Koirala.

A budget generally is a list of all expenses and revenues. It is an annual financial plan of the government revenue and expenditure. It is also known as the statement of the financial plan of the government or fiscal policy.

According to Bastable, “The term budget has come to mean the financial arrangement of a given period, with the usual implication that they have been submitted to the legislature for approval.”

According to World Bank, “The annual budget is usually the authority for the public spending. It is ideally one year’s slice of a medium-term expenditure plan.”In brief, a budget is a detailed plan of operations for some specific future period.

Process of Budget Formulation

Budgeting for the government is an enormously complex process. The process of a budget formulation may vary from government to government and country to country. Some of the common steps of the budget formulation are as follow:

1. Estimate of overall income-expenditure

In the first stage, the planning authority collects the estimated expenditure and possible income from concerned ministries, departments, and local offices of the government and then, discusses with the concerned ministries.

2. Determination of priorities

It is the second step of budget formulation. After determining the amount of expenditure for the next year planning authorities determine the different priorities are based on available resources and needs.

3. Project preparation and Selection

It is the third stage of budget formulation. The planning authorities after making a review of the project, it selects the projects to include the incoming budget. Planning authorities review the financial cost of the project and submission to the budget department.

4. Proposal of new taxes

In the fourth stage, new tax policies are proposed by the finance minister of the government with discussing the experts and stakeholders.

5. Final Document

In the fifth stage, the budget office gives the final shape of the budget. It is completed before the fiscal year commences. It is presented to parliament by the finance minister and discussed in parliament by its member-only after approval from the parliament budget gets final shape, otherwise, it needs amendment.

6. Authorization

The final step of the budget formulation is the authorization of the budget by the legislature. After a long discussion on a budget, it is passed and authorized by the head of the state. After the authorization, it is distributed under the heading and development expenditure.

- Present budget formulation approach:

(Before 1991 mostly top-down approach, after democracy both top-down and bottom-up)

- Top-down approach (for central government):

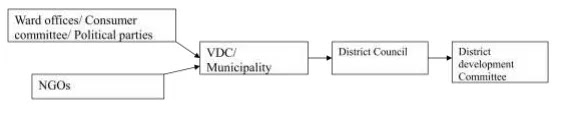

- Bottom-up approach (for local government):

Budget Formulation Cycle

Budget reform after democracy

1. In 2002, Medium Term Expenditure Framework (MTEF) :

- Three-year rolling budget, link the periodic plan objectives to annual budget’s programs and activities

- Clearly defines the priority of proposed programs and projects of the five-year plan that contribute the poverty reduction most.

- Help to formulate development budget, predict government future expenditure

- Updated annually by NPC and MOF

2. 2003/04- the new budget classification system:

- Classifying recurrent and capital expenditure instead of regular and development expenditure.

- Help development budget formulation be more realistic.

3. 2003/04- Immediate Action Plan:

- Helps to prioritize the development activities into priority 1(P1), priority 2 (P2), and priority 3(P3) listed in the annual budget during budget formulation.

- Improve budget effectiveness at a given resource constraints

Government Revenue:

There are two measure sources of government revenue i.e. Tax revenue and Non. Tax revenue.

1. Tax revenue:

Tax is a measured source of government revenue in Nepal. Taxes are compulsory payments to the government without the expectation of direct benefit to the taxpayer. It contributes about 80 % of the total revenue collected in Nepal. The tax revenue inputs the following sources:

- Custom:

It is collected at a custom point located at the border of the nation. It includes export tax & import tax. It contributes about 35 % of the total tax revenue of Nepal.

- Tax on consumption and production of goods & services:

It includes exercise duty, sales tax, VAT, contract tax, road tax, air flight tax, etc.

- Tax on property, profit, and income:

This source includes income tax, vehicle tax, and tax on interest.

- Land revenue and registration:

It includes land tax and land and house registration charges.

2. Non-tax revenue:

The Non-tax revenue contributes about 20 % of the total revenue of Nepal. The non – tax revenue includes the following sources:

- Charges, fees, and fines:

This source includes firm and arms registration, vehicle license, judiciary, administrative penalty, etc. This source contributes about 4 % of non – tax revenue.

- Receipts from the sale of commodities & services:

This source includes income from drinking water, irrigation, electricity, postal service, education, transport, and agriculture.

- Royalty and sale of fixed assets:

This source consists of royalty from mining, forest, mountaineering, etc.

- Principle and interest payment:

This source consists of the loan repayment made and interest paid by the companies and corporations.

- Gifts and grants:

Individuals and governments of various countries give gifts and grants to the government of Nepal. This is also an important source of non-tax revenue for Nepal.

Government expenditure:

The expenditure made by the government for the welfare of the people is called government expenditure. In other words, government expenditure of public authorities i.e. central, state, and local government. These expenditures are made to protect the citizen and to promote economic development.

Classification of Government expenditure:

The government expenditure of Nepal can be classified into two-measure heading:

- Regular expenditure

- Development expenditure

The expenditure made on general government services is called regular expenditure. These expenditures are also called administrative expenditures. These expenditures are recurring in nature.

These expenditures include the following heading:

- Constitutional organs:

- General administration:

- Revenue administration:

It includes expenditure made on the collection of land revenue, custom office, excise department office, VAT department, etc.

- Economic administration:

It includes expenditure made on the planning commission, department of statistics, etc.

- Judicial administraton:

It includes expenditures made on courts.

- Defense:

It includes expenditure made on defense i.e. army.

- Social service:

It includes expenditure made on education, health, drinking water, etc.

- Economic services:

It includes expenditure made on agriculture, irrigation, transport, communication, electricity, etc.

2. Development expenditure:

The expenditure which promotes economic development is called development expenditure. This expenditure is also called capital expenditure. This expenditure is productive in nature.

It includes the following headings:

- Constitutional organs:

It includes expenditure made on infrastructure development of the Supreme court.

- General administration:

It includes the expenditure made on administrative reform of the government organization.

- Economic administration and planning:

It includes expenditure made on planning and statistics of the country.

- Social service:

It includes expenditure made on infrastructure development of education, health, drinking water, etc.

- Economic services:

It includes expenditure made on infrastructure development of agriculture, industry, transport, communication, electricity, etc.

Nepal Budget for Fiscal Year 2018/19

Finance Minister Yubaraj Khatiwada deliver Nepal's first federal budget of NPR 1.31 trillion to the Joint Assembly of Federal Parliament for the fiscal year 2018/19 on 29th May 2018. Economic growth in the upcoming fiscal has been projected at 8 percent. An anticipate creation of jobs for additional five hundred thousand people in the next fiscal year. Inflation will be contained at 6.5 percent.

The following are objectives of the budget:

a) To end extreme poverty, impoverishment, and backwardness by expeditiously fulfilling minimum basic livelihood needs, which are fundamental rights of citizens.

b) to achieve rapid economic and human development by enhancing and optimally utilizing resources, opportunities, and potentials.

c) to build a prosperous, strong, self-reliant, and socialism-oriented economy by developing economic, physical, and social infrastructure.

The priorities of the budget for FY 2018/2019 are as follows:

a) Promotion of sectors that can create jobs and employment opportunities for all citizens,

b) Accelerated human development through the development of the social sector, including health and education,

c) Use of capital, technology, and research in sectors, such as agriculture, water resources, and tourism, to achieve sustainable, broad, equitable, and high economic growth,

d) Development of basic and modern physical infrastructure, such as roads, railways, irrigation, electricity, and urban facilities, to accelerate the pace of building modern Nepal,

e) Reconstruction of structures damaged by earthquakes and floods, and

f) Enhancement in quality of public service delivery, and good governance perceivable by the citizens.

Budget Allocation and Financing

Highlights on Revised Taxation System

Changes in Direct and Indirect Tax

Progressive Taxation System: The government has introduced a new tax slab for the fiscal year 2018/19. The income tax rate has been reduced for lower and middle-income earners whereas higher earners will have to bear an additional tax burden. There shall be three rates for income tax: 10%, 20%, and 30% on taxable incomes. Previously, there were two rates: 15% and 25% in practice.

Key highlights of monetary policy 2075/76 (2018/19)

Nepal Rastra Bank (NRB) has published the monetary policy for the fiscal year 2075/76 (2018/19). To facilitate the GDP growth rate of 8% the central bank has adopted an expansionary monetary policy.

Key highlights of monetary policy 2075/76 (2018/19):

- Cash Reserve Ratio (CRR) and Statutory Liquidity Fund (SLF) have been fixed to 4% and 10% respectively.

- The inflation level for the coming fiscal year 2075/76 has been targeted to 6.5%.

- The interest rate corridor has the following features:

- Priority sector lending for ‘A’ class commercial banks has been fixed to 25%.

- The amount of margin lending has been decreased from 40% of core capital to 20%.

- All commercial banks need to perform credit rating from national or international credit rating agencies.

Trade policy 2072

It aims to promote domestic industries, manage growing imports, boost exports So that trade becomes an engine for the economic development of the country.

Objectives

- To enhance the capacity of export-oriented service firms: (Engineering, Tourism, IT, Business process outsourcing, Health, and Human Resource Development)

- To increase the competitiveness of the domestic product.

- Align the policy with other related policies that have a larger impact on trade.

- To boost production by reducing supply-side constraints.

- To reduce the trade deficits through the promotion of high-value-added exports.

- To promote and protect IPR rights at the regional and international levels.

Strategies

Government plays the role of facilitator, guardian, and regulator increasing the participation of the private sector.

- Reduce trade deficit by reducing the import.

- Goods with comparative and competitive advantages will be identified and promoted in export.

- Improve the competitiveness of export-oriented service areas.

- Decrease transaction costs through procedural simplification and institutional consolidation.

- Expand market by utilizing bilateral, regional, multilateral opportunities with economic diplomacy for trade expansion.

- Improving both the goods and service competitiveness as complementary to each other in terms of the regional and international production network.

- Promoting and increasing trade expansion related to IPR in the global market.

Policies

- Enhancing the role and professional capacity of government and private sector entities.

- Promoting export-oriented products of firms having a competitive and comparative advantage.

- Reducing imports to reduce the trade deficit.

- Increasing competitiveness of export-oriented firms (service).

- Reducing transaction costs through procedural simplification and institutional strengthening.

- Establishing a business as the mainstream of the economy.

- Expand market by utilizing bilateral, regional, multilateral opportunities with economic diplomacy for trade expansion.

- Improving both the goods and service competitiveness as complementary to each other in terms of the regional and international production network.

- Promoting and increasing trade expansion related to IPR in the global market.

Cash Incentive Scheme

- Both processed and non-processed goods

- Other than India

- Flat percent of 1(up to 30%) and 2(more than 30%)

- Based on value addition

Institutional Arrangement

The policy has made provision for the following institutions

i) Board of Trade: It consists of 23 members. Its functions are:

- Assist in trade-related policy formulation

- Coordinate implementation of trade policy

- Recommend amendments in trade policy

- Give suggestions to the government to remove obstacles to open and liberalize trade.

- Carry out other activities related to trade facilitation

ii) Trade promotion institute: Concert trade and export promotion center into an autonomous Trade Promotion Institute

iii) Special economic zones and Processing zones